If you think the Terra/Luna crash of 2022 left lasting scars on the South Korean crypto community, you are wrong. With the bitcoin (BTC) bull market in full swing, Koreans are again diving in head first and snapping up smaller cryptocurrencies.

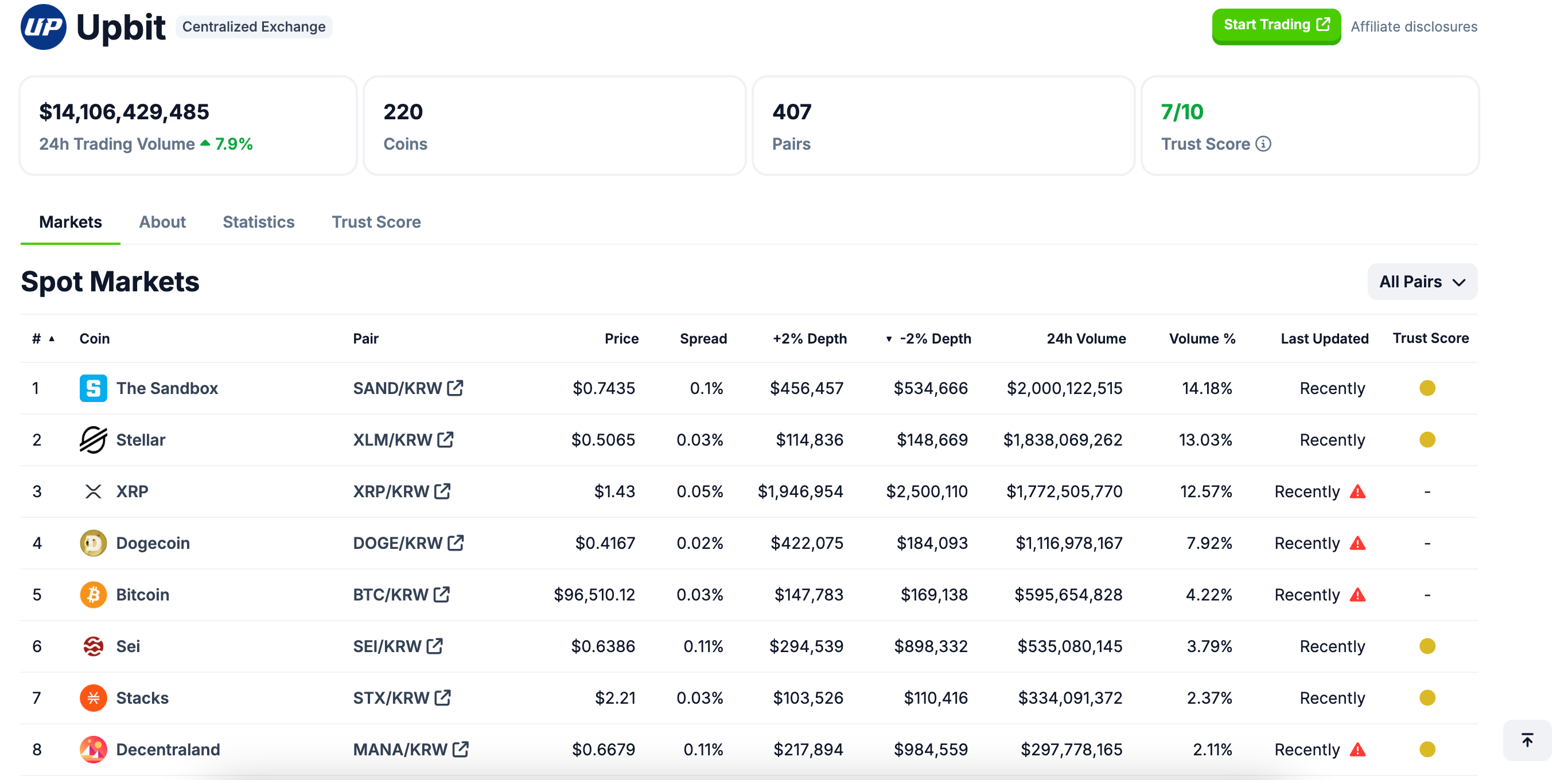

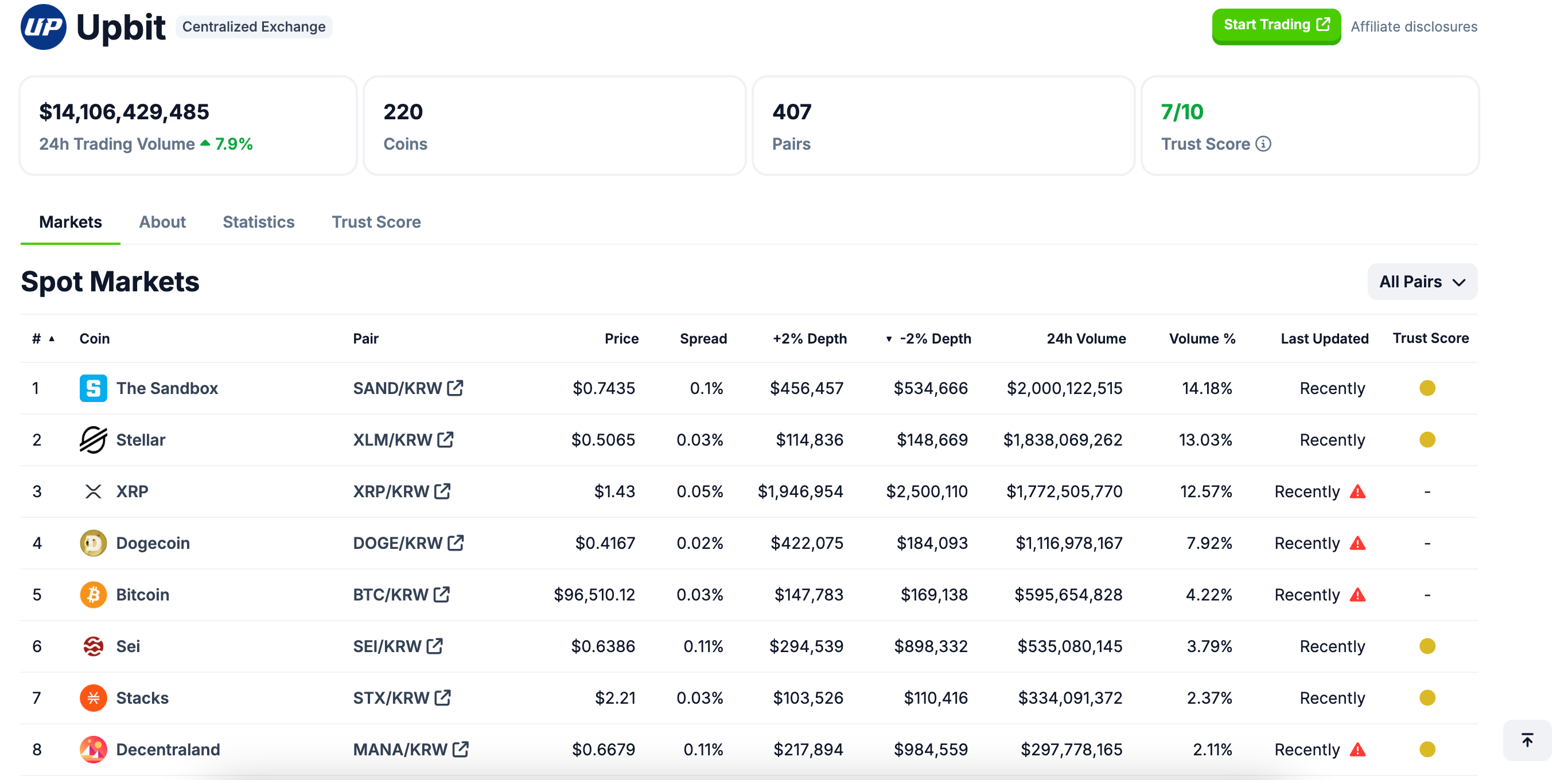

Trading volume on South Korea’s largest exchange, Upbit, which accounts for over 70% of the country’s total activity, has skyrocketed 11-fold to $14.3 billion since the Nov. 5 U.S. presidential election that saw pro-crypto candidate Donald Trump emerge victorious, according to data source Coingecko.

Driving this exceptional volume growth are XRP, dogecoin (DOGE) and other smaller tokens, pointing to a resurgence of retail investor mania.

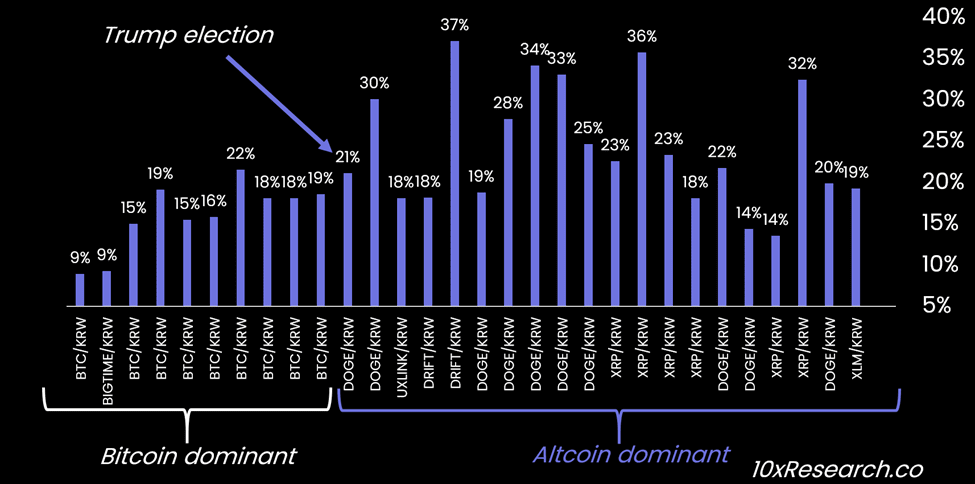

For instance, the DOGE/KRW pair, which represents dogecoin’s price in South Korean won, has been the most traded pair on Upbit for a total of 10 days, according to 10x Research. The XRP/KRW pair has been top six times and the XLM/KRW pair has been the most traded pair of the past 24 hours, accounting for 19% of the total volume Sunday.

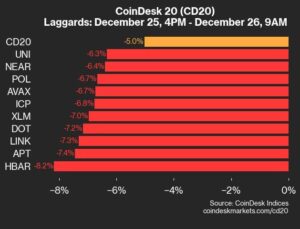

The three tokens have skyrocketed by 164%, 188% and 463%, respectively, this month, though they remain below their respective record highs reached in 2021. Meanwhile, market leader bitcoin is trading at lifetime peaks near $100,000, representing a near 40% price gain, according to CoinDesk data.

“Since the Nov. 5 Trump election, bitcoin’s dominance as the crypto with the highest volume has been replaced by altcoins, such as Doge, Ripple, and Stellar (XLM 19% market share on UPbit on Sunday, number 1 coin traded). Those are the ones with +100% returns, and while simply monitoring those changes in activity would have resulted in a lot of alpha, as we have frequently pointed out,” Markus Thielen, founder of 10x Research, said in a note to clients Monday.

Koreans’ love for cheaper plays is now extending to other crypto market sectors, including metaverse tokens like SAND, which are seeing a meaningful rally for the first in three years.

At press time, the SAND/KRW pair listed on Upbit boasted a 24-hour trading volume of $2 billion, or 14% of the exchange’s total trading volume of $14.10 billion.

The SAND token has rallied over 200% to 76 cents this month, yet it remains well below its November 2021 peak of $8.49. Traders should keep a close eye on the surge in the metaverse and gaming tokens, as the last time these assets rallied, it marked the peak of the bull market in late 2021.

02:00

02:00

News

News

Blog

Blog

Blog

Blog

Blog

Blog

Blog

Blog

Blog

Blog

Blog

Blog