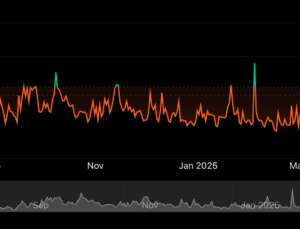

Bitcoin (BTC) clawed its way back to nearly $82,000, staging a relief rally after dipping below $78,000 late Sunday, leading to a slight run-up in major tokens.

Ether (ETH), BNB Chain’s BNB, XRP and Cardano’s ADA rose as much as 3%, alleviating some losses from the past 7 days. The broad-based CoinDesk 20 (CD20) added nearly 4%.

Elsewhere, the U.S. Securities and Exchange Commission (SEC) delaying decisions on XRP, Dogecoin, and Litecoin filings. Bloomberg analysts had previously pegged Litecoin’s odds at 90%, Doge at 75%, and XRP at 65% for an ETF approval by year-end, yet the regulator’s hesitation is keeping the market on edge.

Traders still eye a pullback to the $74,000 level, and below, before an eventual push higher.

“Previously, a similar decline would complete a corrective pullback, attracting buyers,” Alex Kuptsikevich, FxPro chief market analyst, told CoinDesk in an email.

“However, the chances of such an outcome are now lower than in previous years due to the powerful influence of traditional financial companies, which has strengthened the link between the crypto market and stock dynamics.The scenario of a pullback to the $70-$74K area still looks the most probable for us. This is all the truer as the consolidation and rebound in early March has taken the short-term oversold stance out of the market,” Kuptsikevich added.

Gains in BTC came as Senator Cynthia Lummis reintroduced the BITCOIN Act, pushing for the U.S. to scoop up 1 million BTC as a strategic reserve. The bill, which Lummis first introduced last year, would direct the government to purchase 1 million bitcoins over five years.

The first $6 billion in remittances from reserve banks would be set aside each year between 2025 and 2029 to build up the reserve and rely on the Fed’s gold certificates.

Some speculated the possible inclusion of major tokens in such a reserve in the future.

“Altcoins such as XRP, SOL, and ADA pumped higher than expected as pro-crypto Senator Lummis reintroduced her strategic Bitcoin reserve bill to purchase 1 million Bitcoins, and there’s speculation that previously announced altcoins will later be included in the reserve purchases,” Nick Ruck, director at LVRG Research, told CoinDesk in a Telegram message.

02:00

02:00

News

News

Blog

Blog

Blog

Blog

Blog

Blog

Blog

Blog

Blog

Blog

Blog

Blog