After a prolonged downtrend relative to bitcoin (BTC), Ethereum’s ether (ETH) is showing signs of a resurgence.

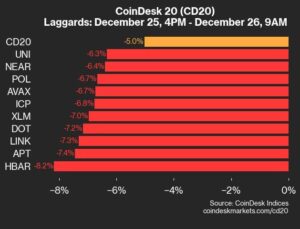

ETH, the second-largest cryptocurrency on the market, gained over 4% in the past 24 hours, while BTC lost 1.5% during the same time, dipping below $95,000 during the Monday session. ETH even outperformed the broad-market CoinDesk 20 Index, which was up 0.5%.

The outperformance happened as investors started to rotate capital to smaller, riskier cryptocurrencies over the weekend following the stall of bitcoin’s near-vertical surge since Donald Trump’s election victory. The ETH/BTC ratio, which measures ether’s strength vs. bitcoin, plummeted to as low as 0.0318 on Thursday, its weakest reading since March 2021, but the gague has gained 15% since to 0.3660 at press time.

“The market seems to be expecting BTC to trade sideways until December as attention shifts towards ETH in the near term,” digital asset hedge fund QCP said in a Monday note.

On the options markets, ETH risk reversals are heavily skewed in favor of frontend calls, meanwhile BTC calls seem to be more bid only from the end of December 2024 onwards, QCP noted. The positioning implies that traders anticipate ether to perform well in the short-term, while bitcoin could pick up pace next year. Risk reversal is a strategy that involves purchasing simultaneously a call option (bullish bet) and a put option (bearish bet) for a specific risk-reward profile.

ETH poised for a rebound vs. bitcoin

“We’re seeing some rotation from BTC to ETH coming from crypto-native hedge funds and family offices,” Joshua Lim from Arbelos Markets said.” Josh Lim, co-founder of crypto derivatives prime brokerage firm Arbelos Markets, said in a telegram message.

U.S.-listed spot ETH ETFs saw their first net inflows on Friday, led by $99 million allocation into BlackRock’s ETHA product, following six days of continuous outflows, data compiled by Farside Investors shows. Holders of ETHA include “the largest names in finance” including $80 billion hedge fund Millenium, analytics firm Kaiko said in a Monday report.

There could be more gains in store for ether against bitcoin in the coming period. The ETH/BTC ratio hit a key support level on Thursday and rebounded, while last week’s candle suggested a trend reversal, well-followed crypto trader Pentoshi noted.

“Quite possible the low is in here and that at least a short term reversal is coming,” Pentoshi said in an X post.

Bitcoin Stalls at $100K

Now extended far above its daily moving averages, bitcoin is likely trade sideways for a while as investors digest the steep rally since Donald Trump’s election victory, said Paul Howard, senior director at crypto trading firm Wincent.

“There is a significant sell wall at the psychological $100K level,” Howard told CoinDesk. “I would expect we oscillate around these levels until the new year. Staying market neutral and buying downside protection here is always a sensible risk reward,” he added.

02:00

02:00

News

News

Blog

Blog

Blog

Blog

Blog

Blog

Blog

Blog

Blog

Blog

Blog

Blog